Energy bills are driven by both the price of energy on the wholesale market and Third-Party Costs (TPCs). TPCs include non-energy costs set by the government, network (the National Grid), policy and system costs and electricity transmission/distribution costs.

The biggest single cost on a bill is the price of the energy. The wholesale cost of the energy makes up approximately 40% of an electricity bill and 70% of a gas bill, with the remaining being TPCs, which have been continuously rising in recent years and can be volatile.

This pricing report will focus on the energy element of a bill to help you keep track and understand the wholesale energy market and the factors affecting the price of your contracts.

Energy Market Overview

UK inflation has hit a 30 year high, with the annual 7% increase in the consumer price index surpassing the highest rise since March 1992. Industry experts predict that these numbers are going to continue hitting record highs throughout 2022.

Energy prices have continued to remain volatile as countries opt for different purchasing methods. Some countries are looking to swap to buying Russian gas in Rubles and others are still pressing for further sanctions on Russian oil. While the EU considers a ban on the importation of Russian coal, this process drives energy prices higher.

While there has been a slight reduction in energy prices, they are still extremely volatile and subject to change. As Russia’s invasion of Ukraine is ongoing, they could cease flows to Europe at any point, which would cause major supply issues and another surge in energy prices.

Bullish Factors (Upward Market Pressure):

- Escalating Ukraine conflict

- Continued concerns over gas flows to Europe

- Increased demand

- Colder forecasts

- Reduced wind generation

Bearish Factors (Downward Market Pressure):

- China and Japan released weaker than expected economic data

Gas and Power

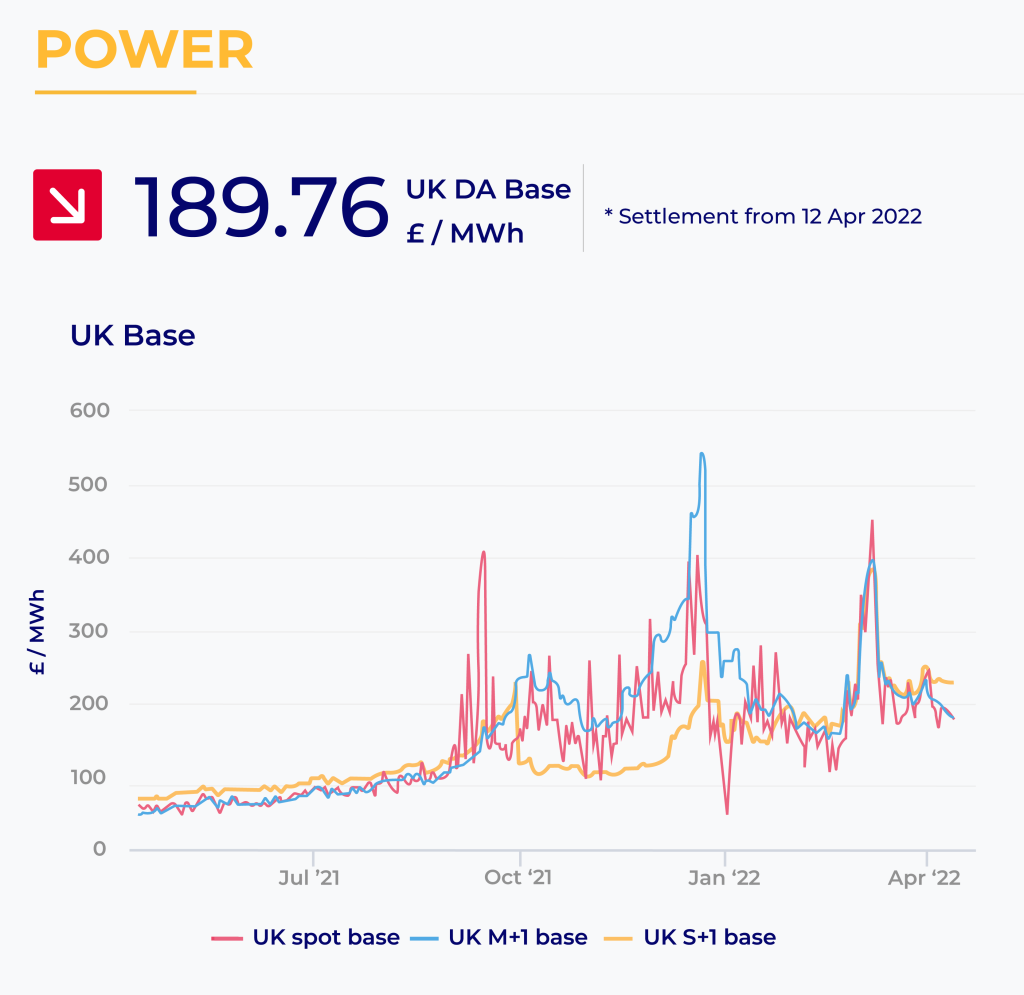

Both gas and power contracts strengthened in mid-April, supported by increased demand, colder forecasts and stronger trading within the coal and carbon markets. Wind generation has also reduced, resulting in a heavier reliance on other elements in the energy mix to meet the demand.

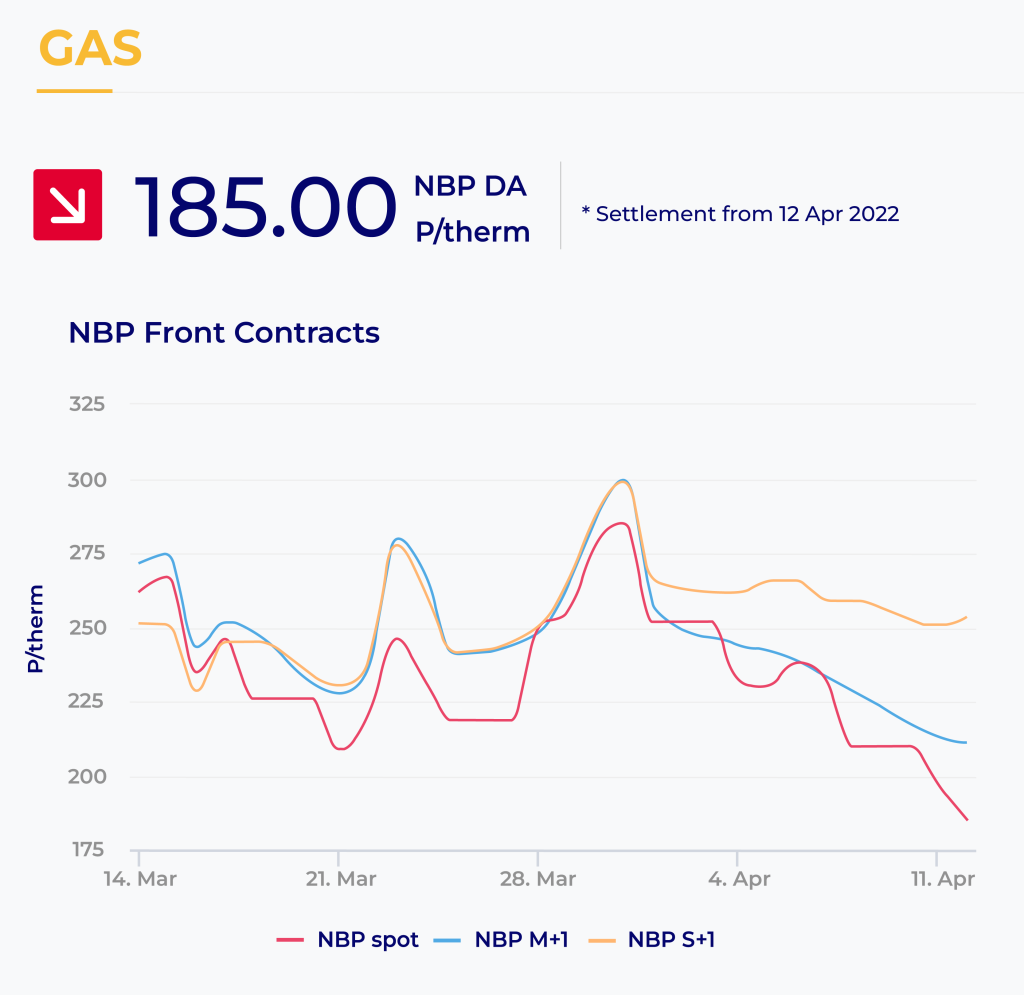

Gas

Power

In the graphs, you can see that gas contracts starting now (Spot) and those within the month ahead (M+1) are slightly lower than this time last month as well as those purchased now for the next season (S+1). If you are not out of contract until summer and have waited to secure a fixed contract, you will be paying a lot more than if you had locked a rate back in January when prices were as low as 150p/therm compared to 490p/therm today.

A season in the business energy market is a 6-month spread and these are from April – September for “Summer” and October – March for “Winter”.

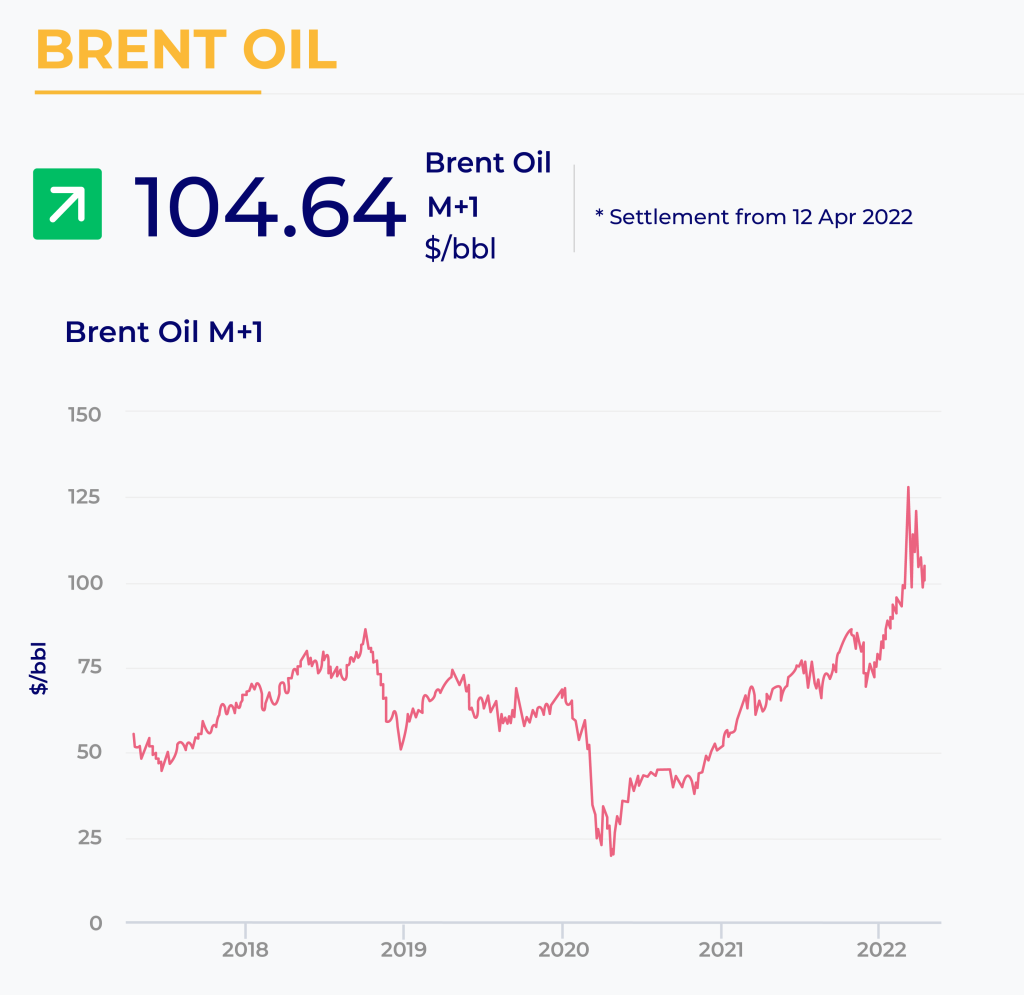

Crude Oil

Brent crude firmed in mid-April as some lockdown restrictions in China were eased, boosting expectations of demand growth, with further value added by missed oil production quotas by some OPEC member countries.

However, it has dropped from above $120/bbl after China and Japan released weaker than expected economic data which could see some damage to demand.

Current price standings:

Brent Crude = $104.64/bbl

Brent Oil

UK Inflation Hits 30-Year High

UK inflation reached its highest record since March 1992 last month, with an annual increase of 7%. This is its highest increase in 30 years, surpassing the 6.2% increase recorded in February.

From April 1st Ofgem increased the price cap for household energy users by 54% following the surge in wholesale energy prices. This includes gas prices reaching an all time high last year with higher numbers being recorded again last month.

Central banks around the world must contend with soaring inflation and stunted economic growth and the Russia-Ukraine war slowing economies’ recovery from the COVID-19 pandemic.

Boris Glass, Senior Economist and Director at S&P Global Ratings, emphasised the likelihood of British inflation rates rising and remaining at record highs throughout 2022. In a similar vein, Ambrose Crofton, Global Market Strategist at JPMorgan Asset Management states that the global supply shock caused by Russia’s invasion of Ukraine means that inflation is likely to peak higher and take longer to mitigate.

“As well as the obvious impact the war has had on consumers’ utility bills, Russia’s key role as a commodity producer extends beyond just energy to many industrial metals and fertilizers,” Crofton noted. “As a result, consumers are likely to see further upward price pressure in goods and food products in the coming months.”

Renewable Energy Prices Soar

Prices for wind and solar power in major global markets have climbed nearly 30% in a year, as developers struggle with “chaotic” supply chains and surging costs. This has affected everything from shipping to parts to labour, according to a report published on Wednesday.

Contract prices for renewables jumped 28.5% in North America and 27.5% in Europe in the last year, according to a quarterly index by LevelTen Energy that tracks the deals, known in the industry as power purchase agreements (PPAs).

The Russian invasion of Ukraine has aggravated these market disruptions during the COVID-19 pandemic, undoing a decade of cost declines in the renewable energy sector. Now there is the danger of higher costs reducing demand growth at a time when the United Nations has called for the expansion of clean energy to challenge the climate crisis.

The war in Ukraine has led governments in Europe to reduce their dependency on natural gas from Russia, raising the demand for renewables. According to Oscar Perez, Fund Manager and renewable energy Developer at Q-Energy, the war has been “the last straw for a market where there was already a lot of price tension.” Luigi Sacco, Head of PPA origination at Milan-based Falck Renewables, also claims “Demand is there but supply is struggling a bit in several markets”.

“There’s just intractable problems right now with our supply chain,” Reagan Farr, Chief Executive of US solar developer Silicon Ranch, said in an interview. One factor luring buyers to renewables is the soaring cost of fossil fuels. Farr claims “The ready alternative to renewable generation right now is gas, and gas prices are up 100% as well”.